This blog post discusses how Managing Cash in Sage Intacct is quick an simple with Bank Transfers. Often times it will be necessary to transfer funds between two cash accounts either within the same entity or across multiple entities. Transferring funds between entities is a feature available in multi-entity installations when the correct permissions are enabled. Whether operating in a multi-entity shared environment or not, you will still be able to transfer funds between accounts in the same entity. The transferring of funds can be done through the Cash Management module within Sage Intacct using any combination of checking accounts, savings accounts and charge card accounts. Fund transfers can also be done between currencies when operating in a multi-currency environment.

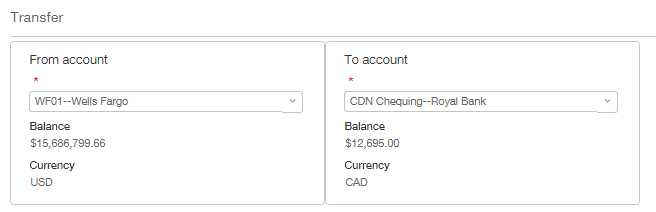

In order to add a new Fund Transfers click into Cash Management > All > Funds Transfer > Add. From the Transfer From account dropdown you will want to select the account you will be removing funds from. In the Transfer To account dropdown, select the account you wish to put the money in. Once an account number is selected in either of these fields the balance of those accounts will be displayed below the account number. When operating in a multi-currency environment the Currency will also be displayed as shown below. Please Note: Multi-currency funds transfers are only allowed when the From Account is the base currency.

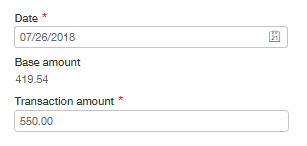

The next required field on this form is the date, which will auto-complete to today’s date. Feel free to change the date to accurately reflect the date of the transfer. In the Transaction amount field you will enter the amount to transfer between accounts. When using a multi-currency environment and transferring between two accounts of different currency you will need to enter the transfer amount in the currency of the To account. In our example above the To account is Canadian Dollars, therefore the Transaction Amount should be entered in Canadian Dollars. Sage Intacct will automatically calculate the transaction amount in the base currency using the exchange rate specified in the lower portion of the input form. When the new transaction is created the Exchange Rate defaults to the Intacct Daily Rate but the power is in your hands to change it to a custom rate if the daily rate doesn’t match the rate given to you by your bank. Should your multi-currency transfer occur in the future, the Intacct Daily Rate will be blank and you will be required to enter a custom exchange rate.

Below the Transaction amount field are the Reference number, Description and Attachment fields. Feel free to use these fields as required but they are optional.

The lowermost portion of the screen is where the dimension values can be selected for this transaction. Although the dimension values are optional by default they are very useful for reporting and tracking. As such we recommend they be utilized. Once you are satisfied with the entries, click Save to record the transfers. Please note that after a funds transfer is created it cannot be voided or edited, however it can be reversed. Join us next week when we learn how to reverse a funds transfer.

Tip: Because funds transfers can be applied to credit card accounts, this functionality is very useful for quickly paying off a credit card. Please be aware that only positive values can be transferred to a credit card account.