Fast access to data has become crucial to making the right decision. Take the following for example. A wealth management organization has an opportunity to invest in a venture of some description, but the window for the decision is a tight time frame. What will that organization need to know before it can make the final decision? What analysis will have to be performed? What systems will data have to be drawn from? Who will need to be involved in the analysis process? In many cases these questions combined with the need to make a fast decision lead to an environment where ad hoc reporting becomes the norm.

In point of fact, to make this decision a financial close is required in order to validate the numbers and be able to make the right decision. As such accounting staff must undertake a variety of checks and balances and account reconciliations to ensure financial reporting integrity is protected – but all this takes time.

The close process is frequently measured in weeks, and less often in days. However, intuitively we recognize that the pace of the business no longer aligns to a monthly, quarterly, or annual reporting cycle as would be the case in this example. Business moves more quickly than this. So, the challenge for finance is to find ways to accelerate the dissemination of information without eroding credibility.

1. Lacking in timeliness – This sort of process necessitates hand offs between a user, finance, and IT. This takes time and the final analysis may be ready several days or weeks after the initial request is made. The decision may be made in the absence of evidential analysis, which could have negative consequenses.

2. Lacking in consistency – The questions asked often come up again and again. The ad hoc analysis must be repeated and updated with each passing period. This activity consumes the resources of those people working in finance and IT.

3. Lacking in control – As data is plucked from various systems and brought together in a spreadsheet, the connection to the underlying data is often broken. One slippery finger or a change to the underlying data can invalidate the analysis. This necessitates additional manual reconciliation controls to ensure the ad hoc analysis remains valid. Many times this step may get neglected altogether giving rise to credibility issues between different sources of information.

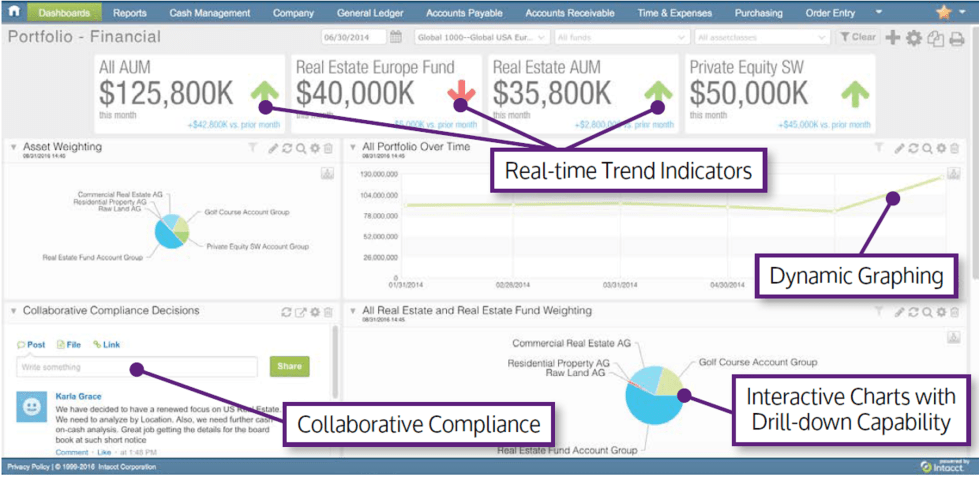

Wouldn’t having information such as the figure on the right, in real time, eliminate the risks that ad hoc reporting poses? Real time data from multiple sources available with a click of the mouse.

Take a tour of Intacct and see for yourself Introduction To Intacct.