Last week we learned when it’s appropriate to use an Other Receipt and how to complete the header portion of the entry form. This week we will continue learning about Other Receipts as we move down into the entries portion of the screen and show you easily disburse miscellaneous deposits.

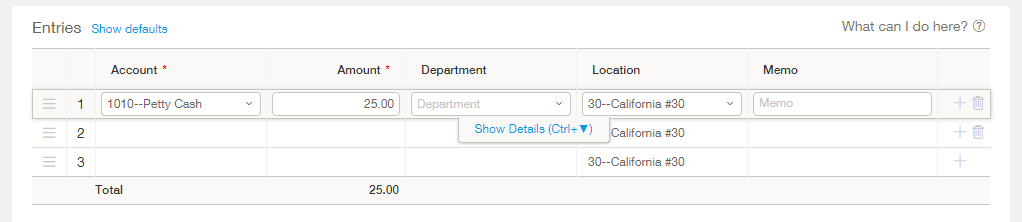

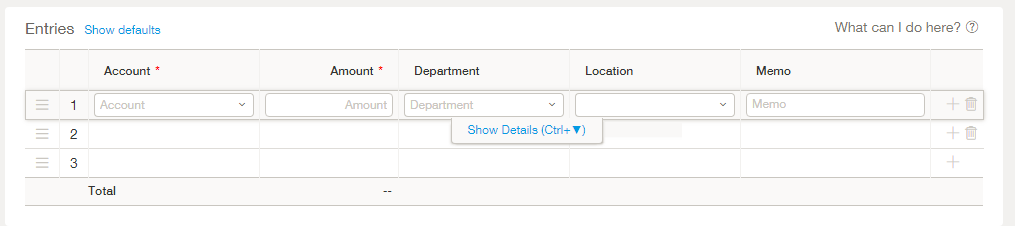

As in any other transactional input form at least one line item entry is required in the Entries portion of the screen. In some instances though you may want more than one line item depending on how you wish to break down the charges as far as GL Accounts and Dimensions go. By default the required fields on the detail, or entries, portion of the screen are only the Account field and the Amount field. There may be more required fields at the line item level depending on the settings in your company.

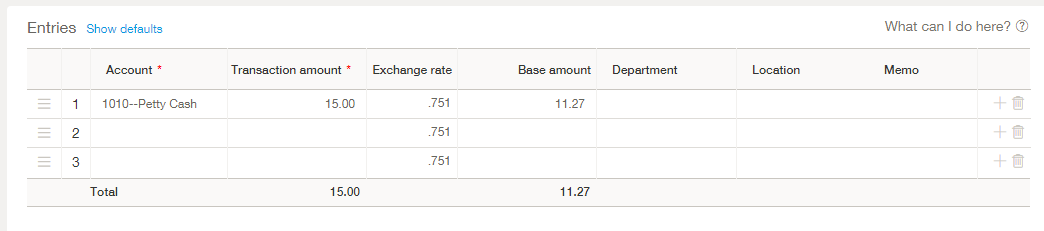

For each line item require on this receipt select an account number and enter a transaction amount. If you are operating in a multi-currency environment you will see two additional columns here for the Exchange rate and Base amount. The base amount field shows the transaction amount converted to the base amount using the exchange rate.

Depending on your company requirements it may be necessary to complete one or more dimension values for each line item. This can be done on the line item itself if the dimension is visible or otherwise on the details screen . The detail screen is accessible by clicking on a field in the line item and then clicking the Show Details link as shown below. Alternately the shortcut key to access this screen is Ctrl+Down.

Prior to saving your Other Receipt, ensure that the information you have keyed in is correct. Once you are satisfied with your data entry, click ‘Save’. It’s important to note that receipts post to the General Ledger and appropriate subledgers in two different ways depending on what type of account you have chosen to deposit it to. If you choose to deposit to a bank account then your receipt will post when you click ‘Save’. On the other hand if you chose to deposit to an Undeposited funds account you will later have to deposit the receipt (i.e. move the funds from the Undeposited account to the bank account) in order to initiate the posting.

Join us next week for more information on depositing Other Receipts that were placed in the Undeposited funds account.