Calculating Taxes on Customer Orders in Sage Intacct. You have now completed the Advanced Order Entry tax setup, congratulations.

If you missed any of our prior posts on tax configuration – make sure to check out our main blog page here.

Now is your chance to make a Sales Invoice and have Intacct calculate the tax for you! Navigate to Order Entry > Activities > Transactions > Sales Invoice > Add. When creating a transaction that will include automatically calculated tax, ensure that you select a customer and ship to in the header portion of the Sales Invoice that are marked as taxable.

Taxes will only be calculated on line items which contain inventory items that are marked as taxable. Your invoice can contain all taxable items, all non-taxable items or a mixture of taxable and non-taxable items. In the interest of explaining how the advanced tax works in the entries portion of the transaction we will ensure that we select an inventory item that has been setup correctly as taxable.

![]()

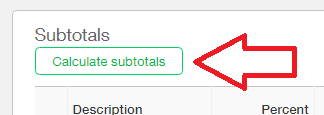

Once the appropriate item is selected and a purchase prices is entered, clicking the Calculate Subtotals button will trigger Intacct to calculate the tax on those lines that are taxable.

After you click the Calculate Subtotals button you will see that your Subtotal line item for Sales Tax has updated to have the tax value displayed. Another line has been added called ‘1) ONHST’ to show the percentage as defined in the associated Tax Detail and the tax has been applied to the line items above that was marked taxable.

Once you are satisfied with your transaction feel free to post it.

After your Sales Order Invoice is posted you can print it from the list screen. You should see all of the subtotal tax lines clearly displayed on the invoice as shown below.

The following will detail the scenario where you have one taxable and one non-taxable line item. In our example below, line item 1 for $6,000 is taxable whereas line item 2 for $500 is not.

![]()

After Calculate Subtotals is clicked you can see that the sales tax was only calculated on the first line item ($6,000 x 13% = $780).

The printed invoice for this Sales Order Invoice displays as expected with the two line items showing and the tax for just one line item being displayed. The customer can easily see which line was taxable and which wasn’t by looking for the T to the right of the line item total.